Navigating the Upcoming Revenue Rule Changes for Reporting of Employee and Director Payments, effective 1 January 2024

As we look ahead to 2024, significant changes are on the horizon for payroll, particularly

As we look ahead to 2024, significant changes are on the horizon for payroll, particularly

A must read from the seasoned Tax experts at Ormsby & Rhodes as we approach

The impact of The Work Life Balance and Miscellaneous Provisions Act 2023 on your Payroll

Regardless of company size, management of cash flows, financial accuracy and maintaining a single source

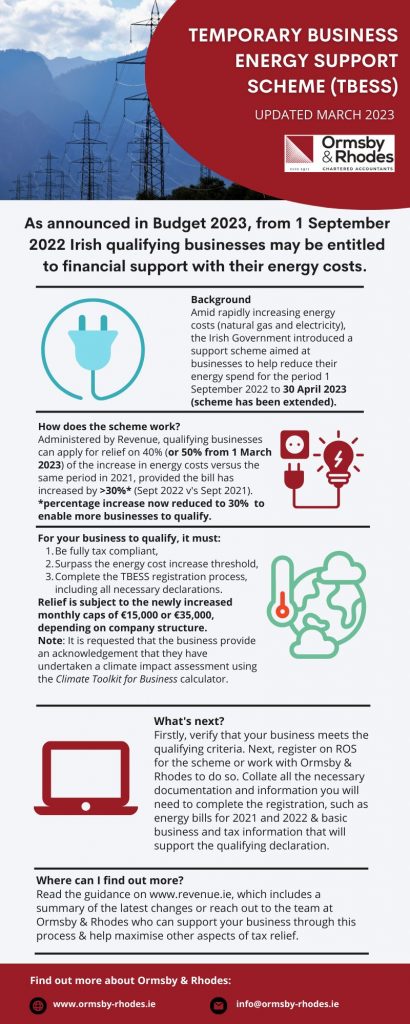

As announced in Budget 2023, from 1stSeptember 2022 qualifying businesses may be entitled to financial

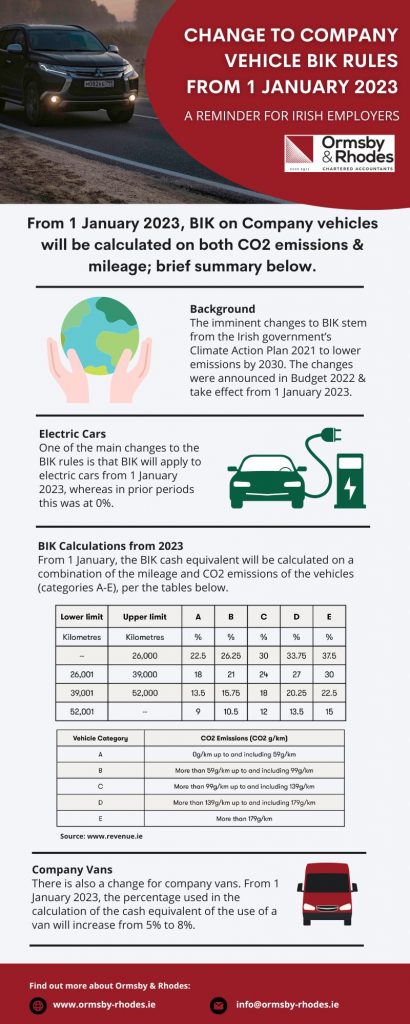

From 1st January, BIK on company vehicles will be calculated on both CO2 emissions and mileage.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |